How I learned to stop worrying & love the ruble

Is a "weak" ruble bad? Depends!

The ruble (or “rouble” in BBC English) is a fiat currency issued by the Bank of Russia (which is not really a bank; come to think of it, it’s not even Russian).

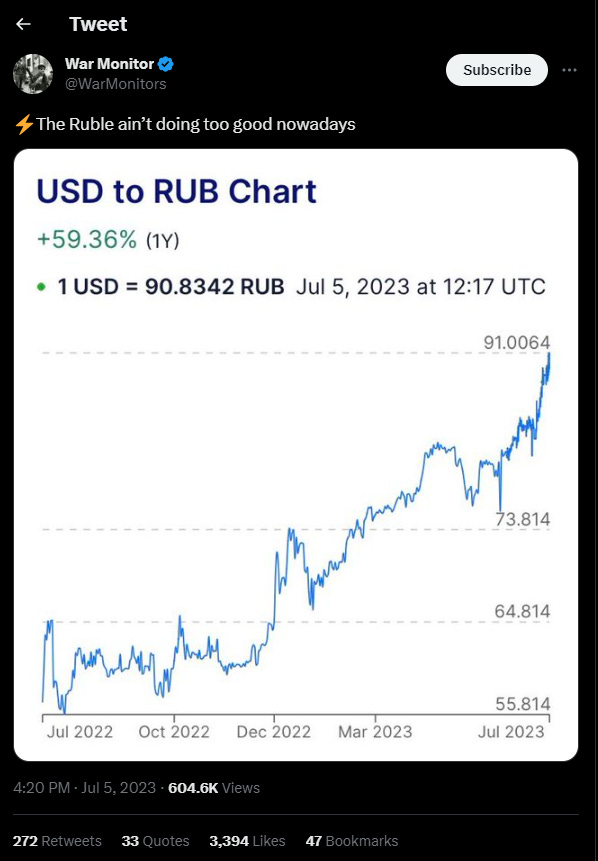

Recently the ruble has been “losing value” against other fiat currencies issued by other central banks. This is meaningful.

But how is it meaningful? This is the question we will attempt to answer today.

The short answer: A “devalued” ruble is bad in some ways, and good in other ways, and guided by your preexisting biases and prejudices, you can make a sound, objective argument that Russia’s economy is about to collapse, or, on the other hand, everything is fine and dandy, and maybe even getting better. Obviously there is no middle ground or room for nuance. Thanks for reading, have a very nice day.

The long answer: Everything I just typed above, but now I will be more specific.

But let’s back up for a moment. Maybe some of you are confused as to why I am even typing this blog post. The reason, dear reader, is because Ruble Mania has once again returned to the internet.

Every time the ruble “gains value”, millions of goofballs flood the internet with profound thoughts like: “CHECKMATE, GLOBALISTS!!” … And then, when the ruble inevitably “loses value”, different goofballs belch: “RUSSIA IS COLLAPSING!!”

The fate of Russia apparently rests on the number of rubles needed to buy one American clam, and how this number is interpreted by anonymous blowhards on the internet.

As of 12 p.m. Moravian Pivo Time, the US dollar is trading for around 91 rubles.

When I first arrived in Russia in 2013, one United States Federal Reserve dollar was approximately equal to 30 Central Bank of Russia rubles. So when people who do not live in Russia, and will probably never even visit Russia, begin to get ants in their pants whenever the ruble “moves” on a line graph, I can’t help but wonder: Are they OK? I really worry about some of them. Guys, it’s the ruble.

It’s worth pointing out that the “official” exchange rate is semi-meaningless and arbitrary, in the sense that a Tbilisi EXCHANGE 0% COMMISSION (LIE) kiosk can demand 100 rubles for a delicious dollar, and could probably get it, too. If you aren’t swapping fiat on the Moscow Exchange, probably you were already paying close to 90 rubles for a dollar. In Russia there is a lively underground currency exchange “scene”, and I can guarantee that the US dollar has been selling for at least 90 rubles for a very long time.

But what does it mean now that the ruble is “officially” losing value? There are pros and cons.

I will compile some useful talking points for you, so that next time you are at a cocktail party, waterboarding your face with Hot Toddies (or whatever you weirdos drink), and some fraud starts babbling about the ruble, you can interject with: “Well, actually…”

Yes, you get to be that guy/gal.

Let’s start with the cons.

Why Russia’s economy is collapsing

If you are praying for economic Armageddon in Russia—which I think is a very rude and bad-karma thing to pray for, but to each their own—the ruble’s recent bad behavior could be interpreted as an omen of doom, I guess.

The reason for this is fairly straightforward: A devalued ruble means imports will be more expensive. And because Moscow’s 10-year plan for “import substitution” did not go according to plan (I’m trying to be diplomatic and gentle), this means Russia still imports a lot of things that it should be producing domestically. (Although the events of the last year have basically forced Russia become more self-sufficient, the reality is that the country’s economy is still heavily dependent on “parallel imports”—sanctioned products that find their way into Russia via a third country.)

Sergei Mironov, the head of “A Just Russia - For Truth” (part of the Uniparty’s Permanent Opposition) faction, summarized this problem in a recent Telegram post:

The fall of the ruble will lead to a rise in prices.

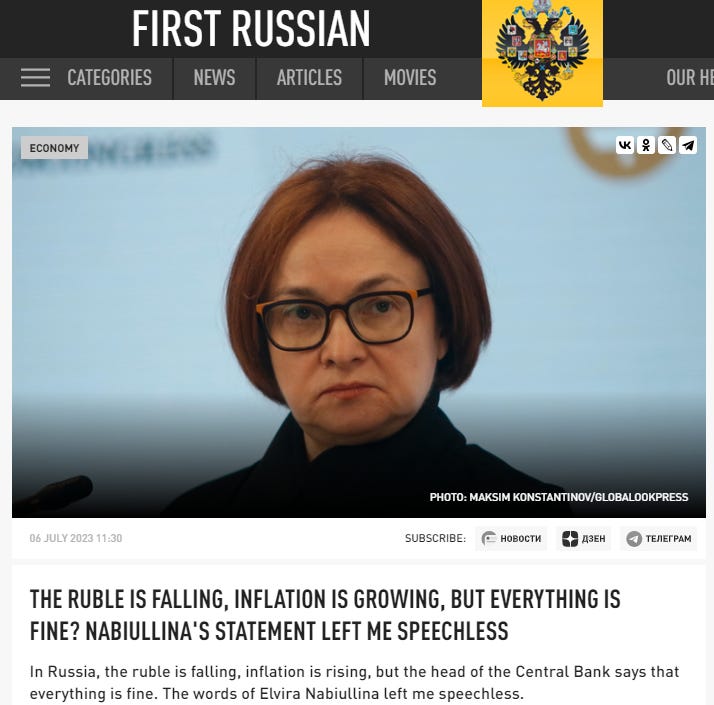

The Central Bank will not be able to rest on its laurels as a fighter against inflation, having given up on the ruble exchange rate. The situation with the national currency proves the need for a radical revision of the functions of the Central Bank.

Ms. Nabiullina admitted that the Central Bank was not responsible for last year’s strengthening of the ruble, and the regulator is not going to do anything about the current collapse. Most likely, such statements will only exacerbate this collapse. There is nothing surprising in the outrageous position of the head of the Central Bank, if we remember that our regulator targets only inflation, sending everything else, including the ruble, into free-flight.

But price tags are already being rewritten in stores: imported household appliances, electronics, and everyday goods become more expensive by 15–30%. Domestic producers will certainly catch up with imports. If the exchange rate is not curbed, inflation will rise. The Central Bank has a “traditional recipe” for this case—raising the key rate, which would be another blow to the real sector and the financial wellbeing of our citizens.

At the end of his message, Mironov said that his party desired the “resignation of the [Bank of Russia’s] current leadership”, which of course is not going to happen, because Russia is ruled by knuckleheads who fail upwards. If anything, expect Nabiullina to receive the Order of Alexander Nevsky, and then replace Putin.

Meanwhile, State Duma Deputy Mikhail Delyagin (another member of A Just Russia, whose colorful outbursts are often featured on this blog) accused Nabiullina of orchestrating a Prigozhin-inspired mutiny.

“The collapse of the ruble is a consequence of the rebellion of Nabiullina, and not [the founder of PMC Wagner Yevgeny] Prigozhin,” the lawmaker mused, adding: “There is no one to be afraid of: the liberals have realized that they have all the power in Russia, just like in the 1990s.”

It’s a touchy subject for some people, but perhaps it’s time to face reality and admit that the sociopolitical situation in Russia is a bit … iffy.

With the presidential election looming, there is currently a Not-War that is not going according to plan (or maybe it is?). To make matters more complicated, a group of mercenaries led by an unscrupulous oligarch recently demonstrated—in a very open way—that maybe there are mixed allegiances in Russia’s military and upper-management. I’m not saying disaster is imminent, but the current situation is rather precarious.

Anyways, the reason I bring this up is because I think Delyagin is onto something here: If the ruble’s devaluation triggers unacceptable levels of inflation, this could be one of several factors that could eventually lead to further internal unpleasantness. (Officially, Russia has managed to rein in inflation. In fact, even if we assume the numbers are slightly fudged, Moscow is undoubtedly handling inflation better than much of the Collective West.)

Also: Tsargrad is really upset and angry at Nabiullina. But they are always furious at her. So maybe that is not a good way to assess economic agitation in Russia.

Weirdly, even friendly banker Herman Gref seems unhappy with the current exchange rate. Gref recently commented that he thought the ruble’s recent fluctuations were suboptimal, and that the ideal range would be 75-78 rubles for 1 Hamburgerland token.

Why Russia’s economy is not collapsing

Russia’s economy has collapsed before (several times, actually), but that doesn’t mean the ruble’s schizophrenia foreshadows inevitable economic ruin—although I’m sure collapse will come, eventually: How else will they get us to use programmable Sbercoins with expiration dates?

Look: A weak ruble isn’t all bad.

If you are selling stuff (like oil and gas), and you receive dollars and euros in exchange for this stuff (and you do, because the “rubles for gas” thing was actually just a barely disguised gimmick), then a “devalued” ruble means you get more rubles for your stuff. And that’s good, because your budget is in rubles, and now you have more money for the budget.

This is double-good because if you have a Ukraine-sized budget deficit (and you do), a weak ruble could potentially help you plug up this financial hole.

Nothing I’m saying here is revolutionary: This is what Moscow has been saying for the last ten years.

It was mildly amusing to watch certain unfortunate corners of the internet cheer for the “strengthening” ruble. Every time Russia’s currency “strengthens” by 1 ruble, the federal budget loses between 130-200 billion rubles in revenue. The 2023 budget is expected to be around 30 trillion rubles. So 200 billion rubles is not chump change. That’s a lot of hookah.

Moscow continues to express the opinion that despite being bombarded by thousands of democracy-spreading sanctions, Russia’s economy has stabilized, and could even see modest growth. Prime Minister Mikhail Mishustin recently revealed that inflation in Russia at the beginning of July amounted to 3.4% in annual terms, and did not foresee it surpassing 5% by the end of the year.

Personally, I don’t think it matters if it’s 70 rubles per dollar, or 100. What’s important is stability and predictability. The reason why the ruble kind of stinks is that it’s volatile. Just choose a number and stick with it. Even Putin was saying this, during the COVID Time of Troubles:

The moral of this blog post is that obsessing over the USD/RUB exchange rate is unwise, and you might think you are “owning” the “other side” by doing so, but trust me, you are not doing that at all.

Until next time,

Riley

The Summer of Blog-Love Sub-Sale continues! $38 for a 12-month subscription that supports award-winning, mind-altering blogging—this is a very seductive offer, no?

Since Liam Neeson is not the only one possessing a particular set of skills, I deduced you are currently raising hell in Czech Republic. It hopefully comes as no surprise to anyone that in the country with over 1000 year long history of brewing beer and comfortably the highest beer consumption per capita, practically all breweries are sold to foreign investors..

Riley, you must try beer from one last bigger Czech brewery that did not sold out - Budejovicky Budvar.

Nice post. Elvira Nabiullina sent $300-400 billion of Russian funds abroad to get seized by the west at the start of the operation. Then Putin renominated her as the head of the Russian central bank. Gee, is it any wonder that she continues to do her master's (the Rothschild central bank owners) bidding and undermine the country?

Per Stanley Sheppard: “Exactly the right definition…"Washington consensus". The term was coined not that long ago, back in 1989, and essentially means how finances of the third world countries should be managed. Initially it applied to South America, but as Soviet Union was dissolved, Russia was given the status like that of Brasil or Argentina. The consensus consists of the three core principles - manage population using Darwinian principles, tightly control money supply primarily by the means of high interest rates, do everything possible to prevent internal investments in the manufacturing sector or anything else working to develop own economy and to create a favorable internal investment climate. The extent to which this consensus is applied to countries varies - Russia gets one of the harshest treatments. Now the bigger question is, how and why Russian fiscal authorities during the all out proxy war are still compliant with imposed rules? This drives many people to conclusion that perhaps this is not a real war between Russia and the West, but a make believe conflict at the expense of Ukraine designed to achieve totally different goals vs. those pronounced by Putin last February.”