On March 25, the Bank of Russia announced it would buy gold at a fixed price of 5,000 rubles per gram. Less than two weeks later, on April 7, Russia’s central bank canceled its new gold-buying policy, opting instead for a negotiated price (at a discount).

The logic behind this move, according to an excellent report by Interfax, is fairly straightforward: sanctions have made it difficult for commercial banks to export their gold to foreign markets. The Bank of Russia is taking advantage of this conundrum by offering to gobble up their gold—at a reduced price. Yes, it’s a bit stingy, but at least it keeps Russia’s gold miners and merchants in business, and it also ensures Russia’s gold stays inside the country. Everyone wins.

But is the Bank of Russia buying gold?

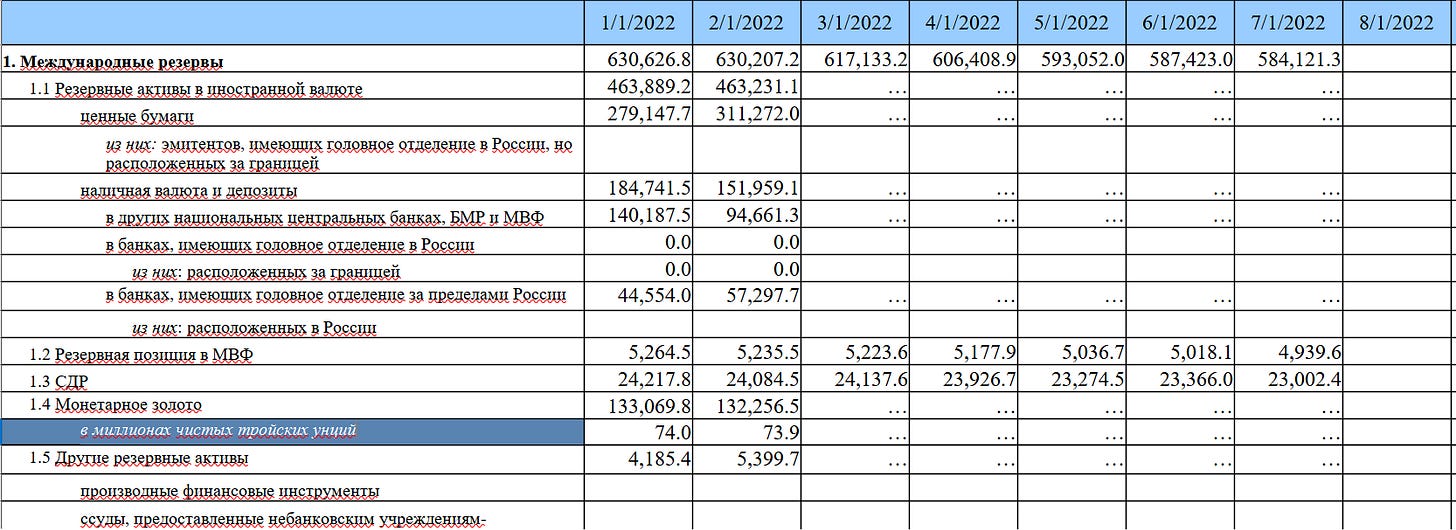

The short answer is: we have no idea, because this information has been classified since March. Pre-February 24, the Bank of Russia published a monthly spreadsheet disclosing the amount of gold and other assets in its possession. Now we are only told the total value of the central bank’s holdings:

In January, the Bank of Russia boasted 74 million troy ounces of gold; in February, 73.9. After that? It’s a mystery.

Okay, but this isn’t necessarily a bad sign. Maybe the Bank of Russia is feverishly and covertly scooping up all the gold it can get its hands on, in order to prepare for the introduction of the “gold-pegged ruble,” which still does not exist?

Maybe, but not according to Tsargrad:

Here’s what Valentin Katasonov, Professor of International Finance at Moscow State Institute of International Relations, told Tsargrad on July 30:

There is no exact information about the Central Bank’s gold operations, since it is classified. We can only build our own guesses based on certain signs. Indirectly, it can be assumed that if purchases are made, they are insignificant.

Unfortunately, it is impossible to say something according to the reports of the Central Bank. Gold is not even singled out in a separate position when the statistics are published. Why doesn't the Central Bank buy up gold on the domestic market? It seems to me that the main financial regulator is playing against Russia. Of course, this is deliberate sabotage. They've been doing it for a long time.

From April 1, 2020 to the end of February 2022, the Central Bank did not purchase gold, and this was reflected in the statistics of the Central Bank. Now everything is closed, but by indirect signs, we feel that there are no purchases or they are minimal. One of the confirmations for me is my contacts with representatives of gold mining companies—they say that they do not receive any orders from the Central Bank. From commercial banks—yes, in theory they can resell gold to the Central Bank, but before such transactions were made directly.

We have to admit this testimonial contradicts our previous assumptions about how the Bank of Russia acquires gold. Our understanding was the central bank deals exclusively with commercial banks. But according to Katasonov, this is not necessarily the case—in the past, gold miners have bypassed the middle man and have worked directly with the Bank of Russia. You learn something new every day.

Kommersant, citing its own experts, also believes the Bank of Russia’s recent gold purchases have been negligible.

As Katasonov concedes, it’s possible commercial banks are selling gold to the central bank. At the very least, we can confirm ordinary Russians are buying precious metals—motivated in part by the government’s decision to drop VAT on such purchases.

According to a recent report by Kommersant, commercial banks have recorded a sharp increase in gold bar sales to private investors. Over the past five months, Sberbank customers purchased 10.9 tons of gold bars. But domestic demand is still low when compared to gold exports in the beginning of 2022.

In April, Russian banks were storing 43.8 tons of gold—and this was after exporting 11.4 tons in February-March.

In May, reserves of precious metals in Russian banks totaled 33.3 tons in gold equivalent. Their holdings increased slightly to 34.6 tons in June.

Would reserves in private banks be considerably lower if the Bank of Russia was making large purchases? Would they be higher in anticipation of sizable and sustained orders from the central bank? We can only speculate.

The thing is: if the Bank of Russia was aggressively purchasing gold, surely Russia’s gold miners would know about it? And this is why Katasonov’s grim assessment of the current state of affairs seems credible to us. But that’s just our personal opinion about this Classified matter.

To be fair to the Bank of Russia, Tsargrad’s super-conservative leanings make it susceptible to assuming the worst when it comes to Elvira Nabiullina and her (admittedly loathsome) central bank. On the other hand, does the Bank of Russia even need more gold if it’s obsessed with shilling zero-privacy, pure Hell, centralized and programmable digital tokens?

Maybe not.

Subscribe to Edward Slavsquat for more gold-pegged ruble updates!

Please don’t speculate too accurately about classified matters, Edward. It’s hard to imagine the U.S. bumping you ahead of actual spies and basketball players on the exchange list.

If, given a choice, a particular fiscal policy action is going to work against Russian economy, we can be assured that Russian CB under Nabiullina will make that choice. Today in interview on radio Sputnik notable Russian economist, Mikhail Khazin, accused the management of Central Bank of "high treason" - this is the harshest accusation of CB I've heard to date at this level. While Russian gold problem is important, just like the water always finds its way through the cracks, so will Russian gold find the way to international markets, since gold is an untraceable store of a well preserved value.

The more important problems in Russia, as they relate to CB policy, they have actually two problems:

1. In Russia, that starts to experience sanctions induced economic slowdown that creates conditions of stagflation and deflation, the CB base interest rate is now at 8% after it was recently dropped from 9.5%. This results in business and consumer cost to borrow money at well above 10% annual rate. It is pretty clear to any serious economist in Russia advocating economic growth that CB base rate should be 2%-3% maximum with the end consumer-business rate at 4%-5%, but CB continues suffocating Russian economy through high interest rates and keeping overall liquidity (printed available money) low.

2. Another problem, especially for business and particularly for manufacturing business is the collateral problem. Even with low interest rates, at, let say, 5%, that doesn't completely consume profit margin that doesn't go beyond 10% in manufacturing sector they are factually banned from taking new loans, because their factories have already been submitted as collateral for prior loans. This is, btw, how Russian industry that came as legacy of USSR's great industrial might was decimated back in the nineties - through "collateral auctions", but this is a topic for a separate comment. You may argue, but that is a problem between the private bank and a borrower? Actually no, Russian CB rules oblige private banks to secure collaterals for their loans or risk losing banking license for not complying.

Overall to better understand economic situation in Russia one needs to know the following fundamentals:

1. Russian currency, the ruble, is a sanitized dollar. Amount of the currency that Russian CB can print is limited not by economic need, desired liquidity level, inflation etc. It is limited by the foreign reserves of the CB, essentially by how many dollars they have. This was the agreed upon model after USSR capitulated after the Cold War back in 1989 and CB religiously stays true to this agreement. This is why Nabiullina gets praises from the Western officials and press. In 2015 she was recognized as the best Central Bank president in the world by the Euromoney magazine after she devalued ruble by 50% in a space of two months in 2014.

2. Neither Putin, nor his government have full authority over Russian finances. While there is always some play in this regard, Russian fiscal authorities, including Ministry of Economic Development and Ministry of Finance are free to drive their own policy that can diverge 180 degrees from the needs and wants of the rest of the government. For example, in order to create new weapon classes and overall stronger army they had to organize almost a clandestine program, totally nontransparent to the own fiscal authorities and drive it for over a decade. That much is true for US as well, except that this approach of "black military budget" was executed for many decades. Remember what Donald Rumsfeld said about Pentagon's "black budget" just ahead of the events of 9/11.

Hope this longer comment will help those who want to know to better understand what is going on with Russian finances.