Look around you: the world is full of mistakes.

But there is one place where, despite all our constant human failings, errors never take root. This place is called “indy” media.

Indy media is special because it has no agenda and is committed to sniffing out the Truth, no matter where it may lead. And unlike lamestream talking heads on teevee, indy media pundits are always eager to engage in good-faith dialogue guided by evidence.

For example, we were taking a stroll through the Indy Media Marketplace of Ideas when we heard the following exchange between a Trusting Reader and a Serious Pundit:

“Greetings, Mr. Serious Pundit,” the Trusting Reader said. “Your reporting on the ‘gold-pegged ruble’ seems a bit off. In fact, all available evidence shows your reporting is entirely incorrect and contrary to observable reality. Maybe you can type up a quick update to avoid misleading your trusting readers and viewers?”

“Thanks for letting me know. I will correct these errors immediately,” Mr. Serious Pundit replied.

“Cool. Now I trust you even more,” cooed the Trusting Reader. “Even though you sometimes make mistakes, you’re willing to acknowledge them. To me this is a clear sign that you are a sincere person operating in good-faith.”

“Thank you. That’s very nice of you to say,” Mr. Serious Pundit responded.

And then we woke up from our dream and quietly sobbed.

It’s time for an intervention, friends. It’s time to ask why so many Serious Pundits continue to pretend the ruble is pegged to gold.

Reality: A brief summary

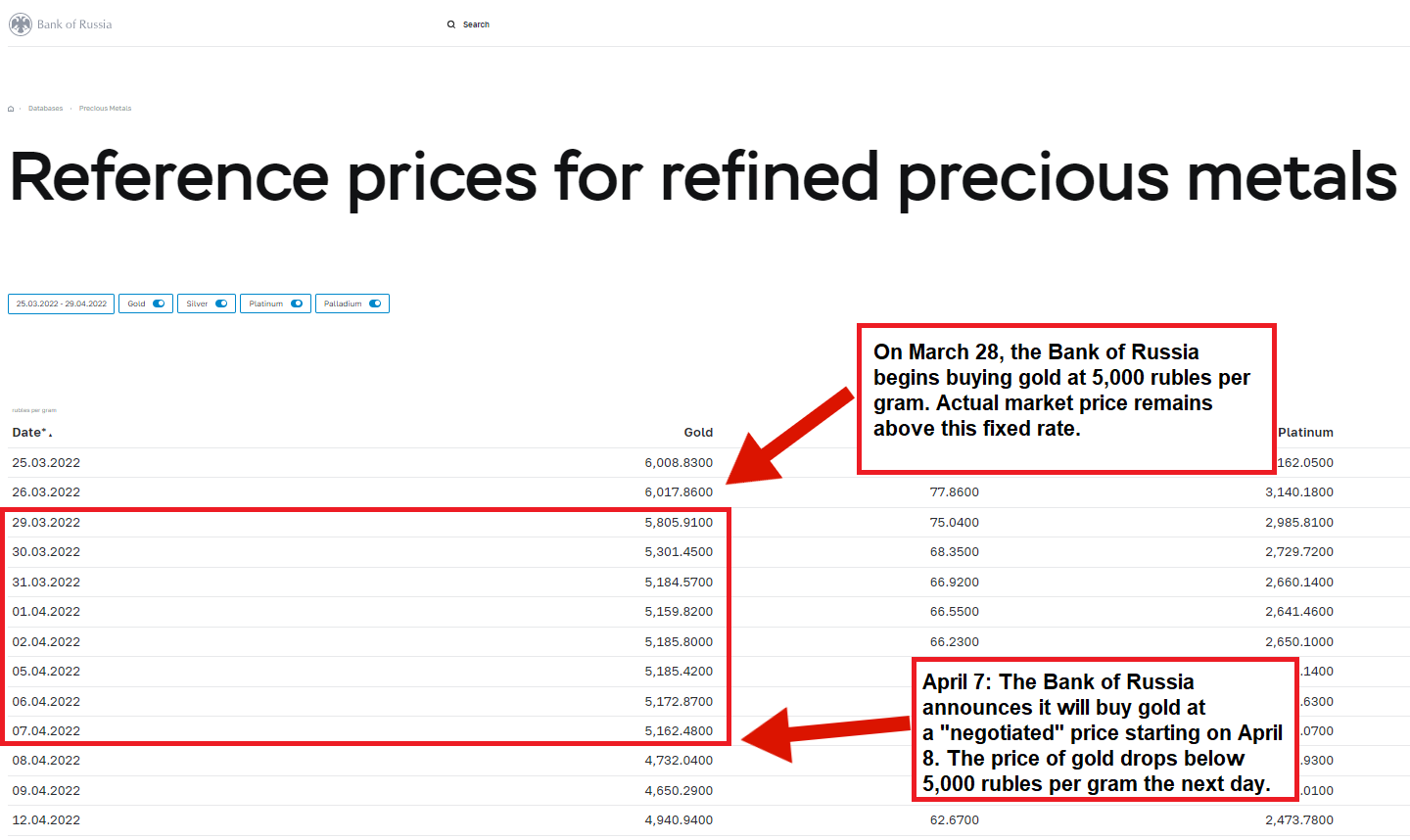

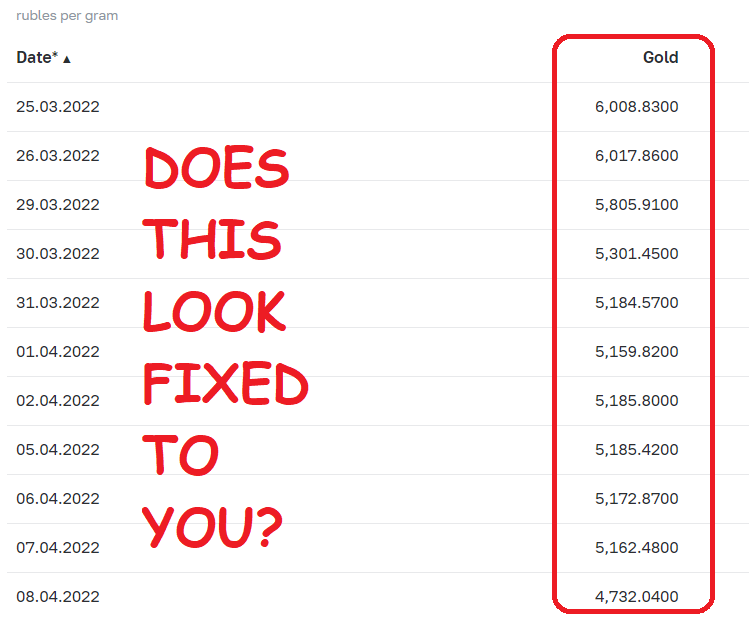

On March 25, the Bank of Russia announced it would buy gold from credit institutions at a fixed price of 5,000 rubles per gram. The policy, which would begin on March 28 and last until June 30, aimed to “balance supply and demand in the domestic precious metals market.”

“The established price level makes it possible to ensure a stable supply of gold and the smooth functioning of the gold mining industry in the current year. After the specified period, the purchase price of gold can be adjusted taking into account the emerging balance of supply and demand in the domestic market,” the CBR said in its statement.

As Gold.ru wrote on March 31, the Bank of Russia wanted to provided Russian mining companies with a “fixed basis for calculations, making it possible to economically mine gold, despite high inflation in the country and the extremely unstable ruble exchange rate.”

In other words: the 5,000 rubles per gram was a “guaranteed” price that Russia’s gold miners could rely on during extreme market fluctuations.

But this “fixed” price only applied when selling gold to the Bank of Russia.

As it turns out, the CBR got cold feet. When the actual market price of gold dropped below 5,000 rubles per gram, the Bank of Russia dropped its “fixed” rate.

On April 7, the Bank of Russia announced that “due to significant change in market conditions,” gold purchases would be carried out at a negotiated price starting the next day.

What does this mean?

As one Russian media outlet observed on April 14:

The motives behind the earlier decision, with the “gold peg”, were simple: the Bank of Russia simply wanted to buy gold cheaper, taking advantage of the fact that it became more difficult to export gold from Russia due to sanctions.

As soon as the dollar fell to 80 rubles or less, the Central Bank’s interest in buying up the yellow metal [at a fixed price] faded.

For those interested in a fact-based overview of the “gold peg” saga, we strongly recommend this feature published by Interfax on April 19.

There is no nuance here. Even during the extremely brief period when the CBR had a fixed price for purchases, the ruble was never “pegged” or “linked” to gold.

But that’s not what the English-language “pro-Russia” pundits reported. Quite the opposite.

The imaginary, English-language gold-pegged ruble

On March 28, Tom Luongo published an article on his blog titled “#GotGoldorRubles? Russia Just Broke the Back of the West.”

“I don’t think everyone has yet caught the significance of Russia announcing they are putting a floor under the price of gold. But, to be clear, Russia just broke the paper gold suppression scheme,” Luongo wrote.

Pepe Escobar, writing for Strategic Culture Foundation on March 31, claimed the “master coup by the Russian Central Bank” was the opening salvo of a new “resource-based global reserve currency.”

“Coupled with No Rubles No Gas, what we have here is energy de facto pegged to gold,” Escobar proclaimed.

On April 1, OffGuardian and Unlimited Hangout hosted a roundtable discussion titled: “Russia & the Great Reset - Resistance or Complicity?”

Your correspondent was one of the participants. So was Luongo, who declared during our discussion:

The hammer here is that [Putin] just pegged the ruble to gold. There’s no greater offense to take at this moment in time than to peg the ruble to gold.

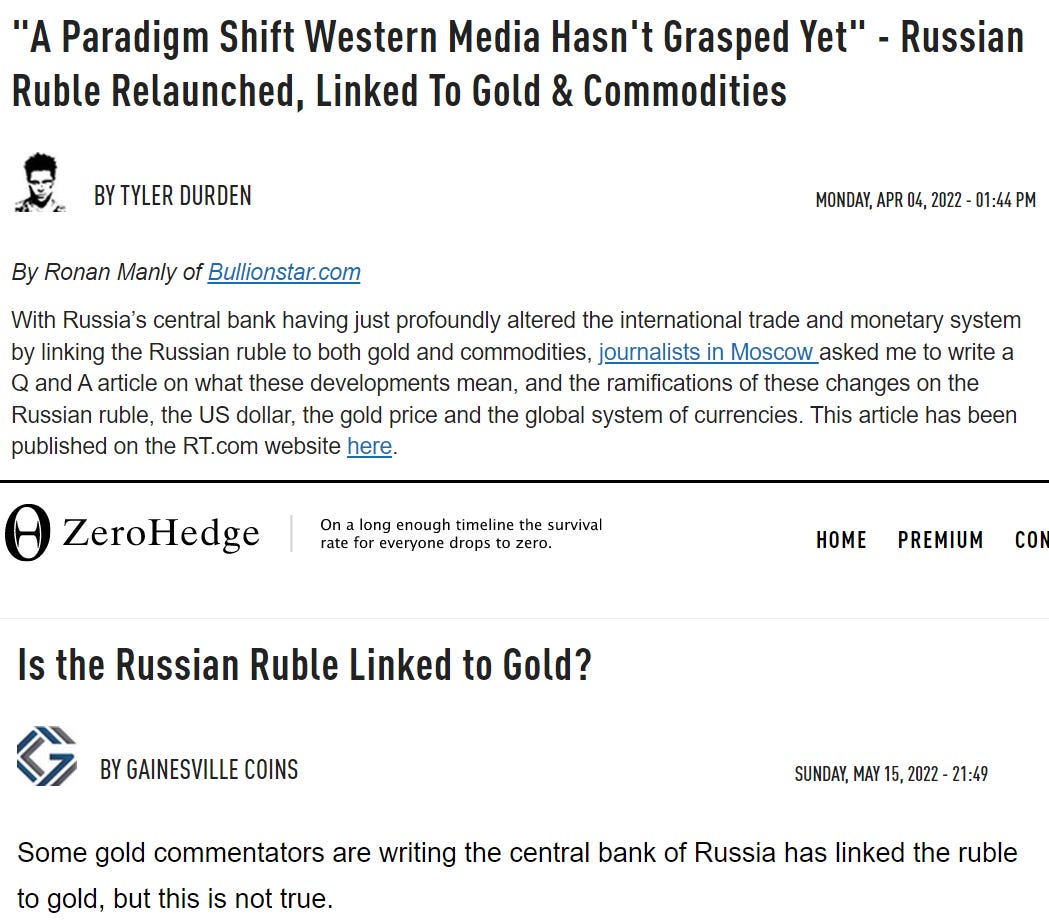

On April 2, RT published an interview with precious metals analyst Ronan Manly. Manly stated unequivocally that the CBR’s fixed price for gold purchases meant the ruble was now “linked” to the yellow metal.

On the same day, Strategic Culture Foundation republished Luongo’s article, labeling it an “Editor’s Choice.”

Alexander Mihailov, an associate professor in economics at University of Reading, published an article at The Conversation on April 5 that alleged the CBR’s fixed price for buying gold represented “the first time that a nation’s currency has been expressed in ‘gold parity’ since Switzerland decided to stop doing so in 1999.”

In his opening sentence, Mihailov includes a link to Manly’s highly creative interview with RT.

The associate professor’s own claims were so fanciful that Russian-language media felt the need to intervene.

“Alexander Mihailov believes the Russian Central Bank has set a fixed exchange rate for the ruble in gold terms, but in reality this is not the case. The Central Bank did nothing of the sort: it only stated that it was ready to buy gold from banks at 5,000 rubles per gram at any time,” Naked-science.ru wrote on April 14.

Tellingly, we failed to find a single article in Russia’s business and financial press claiming the CBR’s policy was tantamount to “linking” or “pegging” the ruble to gold.

Pravda.ru—Russia’s Daily Mail-esque “news” source—ran an article on April 4 based on Manly’s Q&A with RT. If the ruble had indeed been “linked” to gold, surely Pravda.ru could have cited comments from a Russian-speaking analyst?

Meanwhile, the imaginary gold-pegged ruble continued to receive accolades from the English-language “independent” media.

On May 3, James Rickards described the (already defunct) 5,000 rubles/gram policy as a direct assault on the US dollar’s status as the global reserve currency:

It’s no longer a matter of a major event on the horizon; it’s occurring in real-time. Russia has just linked the ruble to gold at a rate of 5,000 rubles to one gram of gold.

He typed these words almost a full month after the CBR dropped its “fixed” price for buying gold.

The hot takes on Twitter have been equally impressive.

Have any of these sweeping, sensational claims been corrected? Have there been any attempts in the so-called “pro-Russia” media to recalibrate its imaginative portrayal of the Bank of Russia’s underwhelming, short-lived policy?

To its credit, RT reported on April 8 that the Bank of Russia had “readjusted” its gold buying strategy.

But none of the above-mentioned analysts have publicly acknowledged that the CBR’s fixed price—which never constituted a “peg” in the first place—no longer exists.

On April 29, Manly posted a blog in which he continued to pretend that the Bank of Russia’s non-existent “fixed price” still existed:

In late March when the Bank of Russia offered to buy gold from Russian banks at a fixed price of 5000 rubles per gram, this was the first step in linking the ruble to gold.

He even bragged about all the views that his interview with RT had received after it was republished by Zerohedge:

This was all laid out in the Q&A article that I wrote for RT.com and which can be seen here on the BullionStar website titled “Russian Ruble relaunched linked to Gold and Commodities – RT.com Q and A”, and which was a big hit on ZeroHedge with more than 650,000 views.

Again, this was on April 29—three weeks after the ruble’s alleged “link” to gold had disappeared.

Zerohedge did what it always does: it hyped a highly dubious story for clicks, then announced “it was just a prank, bro” a month later.

What’s the status over at Gold, Goats ‘N Guns?

Luongo has clung to the mythical gold-pegged ruble—albeit with slightly less enthusiasm than before.

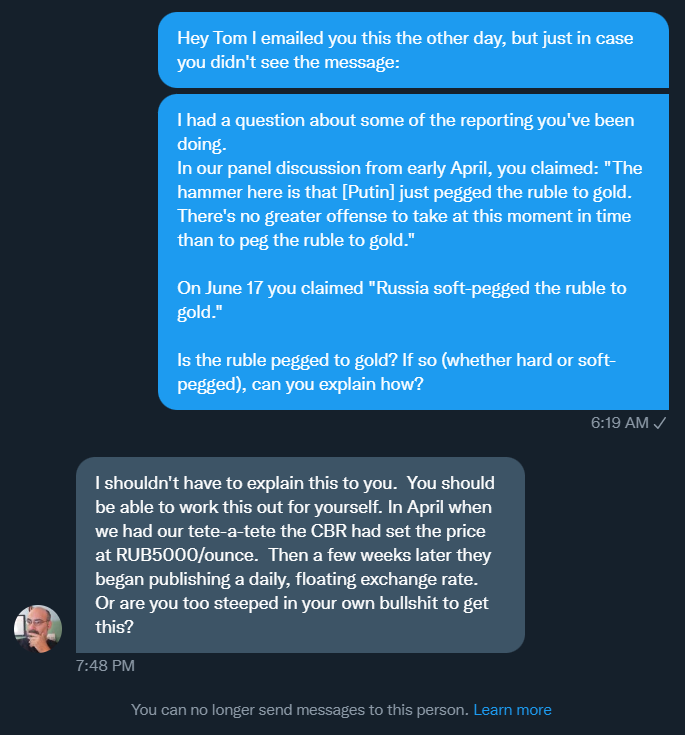

On June 17, he claimed Russia “soft-pegged the ruble to gold” in March. No mention anywhere that this “soft-peg” (what does that even mean?) no longer exists.

We recently asked Tom if he could explain how the ruble was (hard or soft) pegged to gold. His response:

“I shouldn't have to explain this to you. You should be able to work this out for yourself. In April when we had our tete-a-tete the CBR had set the price at RUB5000/ounce [gram, Tom. Gram — Edward]. Then a few weeks later they began publishing a daily, floating exchange rate. Or are you too steeped in your own bullshit to get this?” Luongo replied, before blocking your correspondent on Twitter.

But the exchange rate was always floating—there is not a single day between March 28 and April 7 that the price of gold was “fixed” to 5,000 rubles/gram.

Tom knows this.

The mythical “gold-pegged ruble” briefly resurfaced on April 26, when Security Council Secretary Nikolai Patrushev said the Russian government was toying with the idea of backing the ruble “both with gold and a group of goods.”

Patrushev’s comments became the new battle-cry of countless pundits who declared a month earlier that the ruble was already pegged to gold. Sort of weird, no?

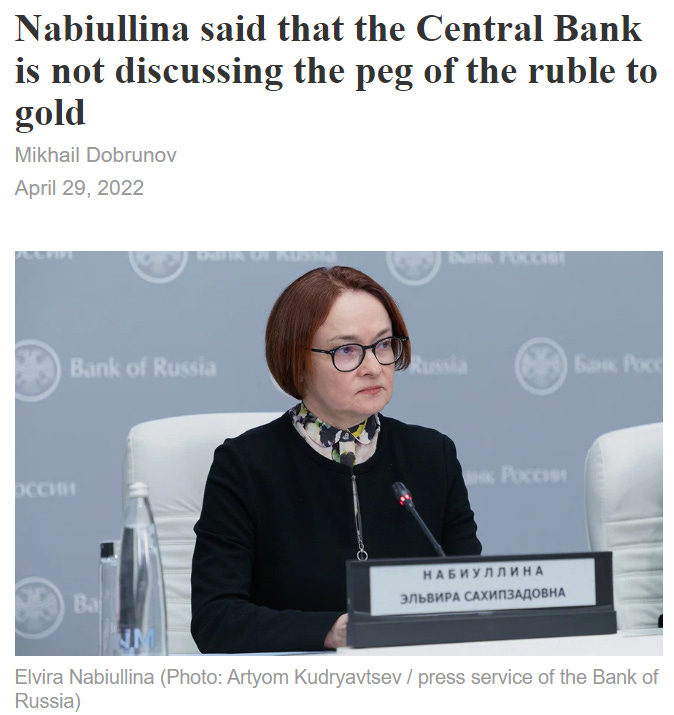

There was far less excitement when, on April 29, Elvira Nabiullina said the Bank of Russia wasn’t even discussing the possibility of tying the ruble to gold. Actually, there was no mention of this statement anywhere in English-language “pro-Russia” media.

Also sort of weird, no?

How is it that in Russia, everyone knows that the ruble is not pegged to gold—but at the same time, apparently tens of thousands of disaffected westerners are convinced that the ruble is “pegged” or “linked” to gold, because of a CBR policy that no longer exists and never linked or pegged the ruble to gold?

Is this OK?

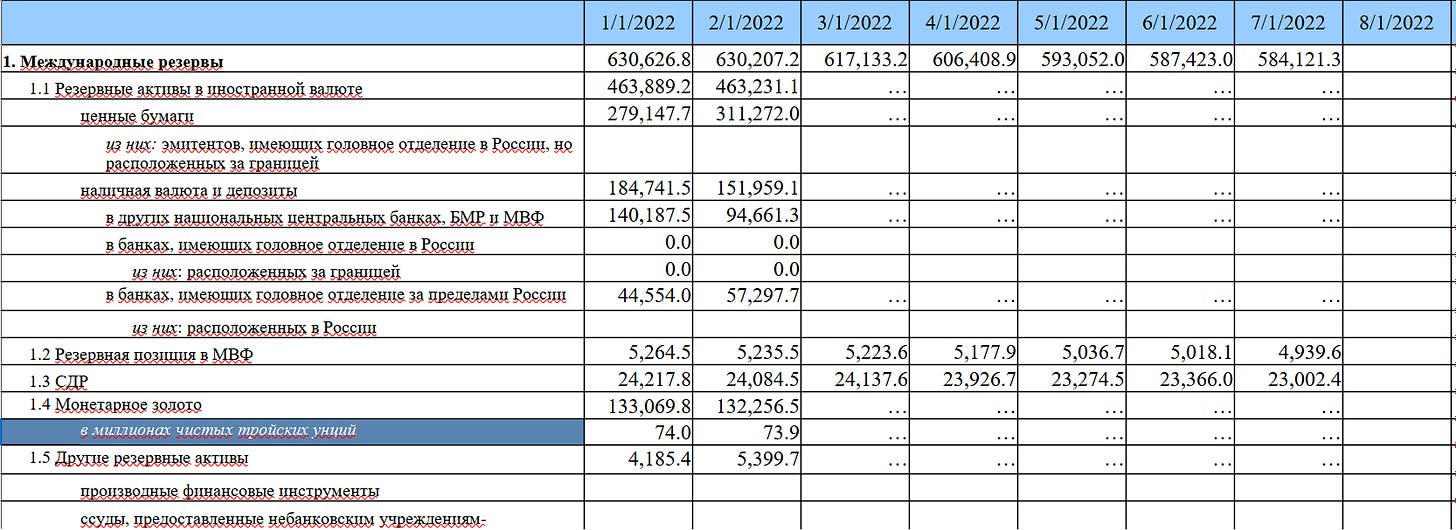

By the way: How much gold is the Bank of Russia buying? Giant mountains of yellow metal, every single day?

We don’t know because the CBR announced on March 30 that it would stop publishing its gold holdings.

Russian media, citing sources, has started to ask uncomfortable questions about what the Bank of Russia is up to.

According to both Tsargrad (ultra-conservative, anti-Nabiullina gold bugs) and Kommersant (a buttoned-down normie rag), the Bank of Russia hasn’t been buying much gold since it “resumed” purchases in early 2022. In fact, it’s possible the CBR has been buying zero gold.

Do you understand what this means?

It means English-language “independent” media has been going crazy over a short-lived, benign gold-buying policy that was very likely never used in any meaningful way, even during its less-than-two-weeks of existence.

It means “indy media” has created an alternate reality—an upside-down garbage world fueled by RT claptrap.

It means total System Failure. Or maybe this is another stunning “indy media” success? Depends on how you look at it!

While you’re waiting for the gold-pegged ruble to arrive, watch this very insightful and informative RT Documentary about the soft-pegged ruble:

For more exclusive RT Documentaries, subscribe to Edward Slavsquat!

But we’re still going to get the digital ruble, pegged to enslavement, right? Don’t shatter all my dreams.

I can't stand how Luongo, Ehret, and others are so willfully blind.

They're such fan boys that they ignore evidence to the contrary and then gaslight anyone that has a good point.

Same fkin thing with the vaccines and convid, like they're really dumb or just doing this to appeal to the people that want a hit of hopeium.

Either way, these guys are a joke and I stopped following them months ago.

Tom Luongo is an ahole in his response to that question. Sounds exactly like the "trust the science" people, instead "trust Russia".