Readers of this blog will likely be familiar with the following chronology of events: 1) On March 30, 2020, the Bank of Russia announced it would halt gold purchases. 2) In April 2020, the Russian government decided to ease restrictions on the export of gold and began issuing licenses to gold mining companies to sell their shiny metal abroad. 3) In June 2021, Putin signed a law that canceled requirements for the repatriation of foreign exchange earnings from gold exports. 4) By November 2021, Russia’s gold miners were exporting almost everything they produced. 5) In late December 2021, the State Duma requested information about why the central bank had stopped purchasing gold. 6) Russian news outlets are now yelling about “an unprecedented [gold] robbery” and have accused the Russian government of legalizing a new form of capital flight.

So imagine our surprise when we came across this titillating headline from RT.com:

This is basically clickbait trash. Let’s start with the headline.

“Russia reveals record high stockpiles of gold”—no it didn’t?

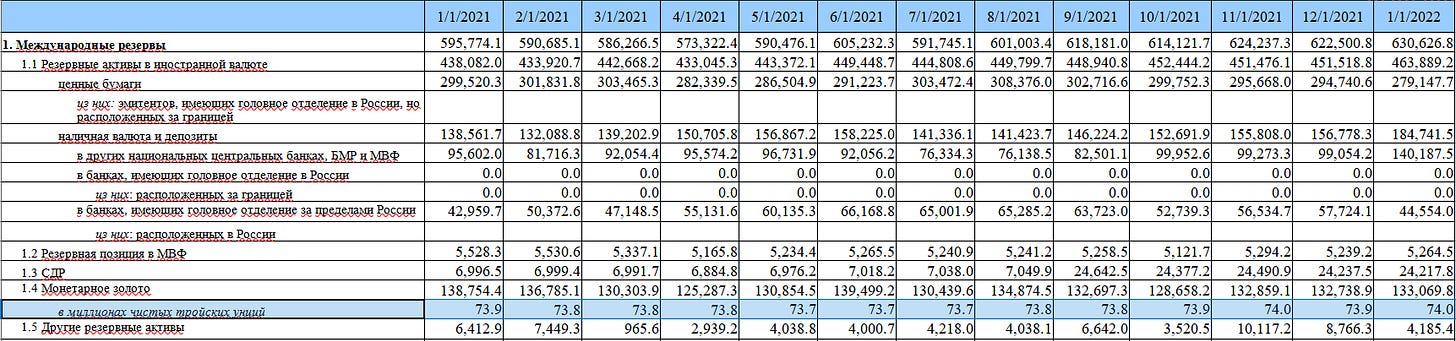

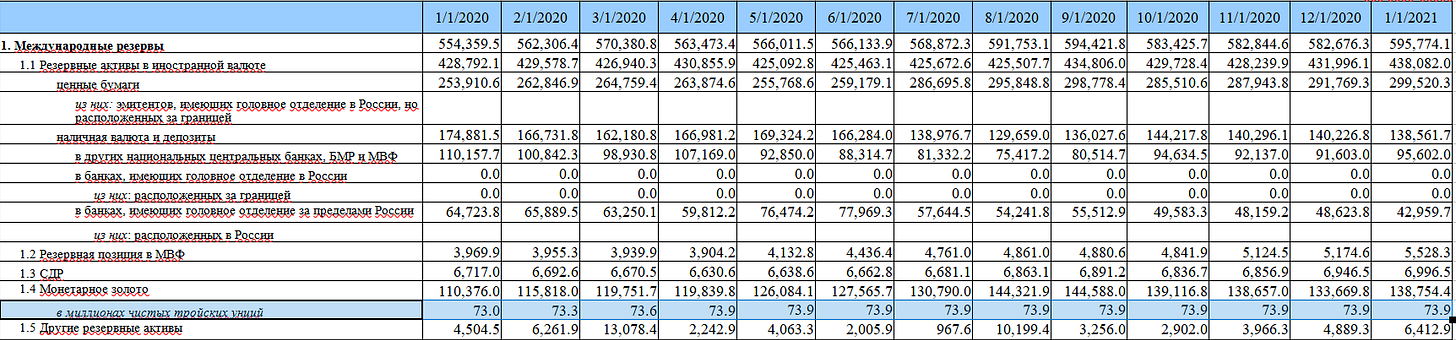

According to the most recent, publicly available data, the Bank of Russia has 74 million troy ounces of gold. This is the same amount of gold the central bank had in…. November. It’s not a “record.”

In April 2020—when gold purchases were halted—the Bank of Russia boasted 73.9 million ounces of gold. This means that over a period of more than a year and a half, the central bank added 100,000 ounces to its gold reserves—3.1 tons over a period of more than 20 months. Just to give you an idea of how underwhelming this figure is: in 2019, Russia’s central bank scooped up 158.6 tons of gold.

RT’s creative headline—clearly tailored to get people horny about all of Russia’s delicious gold—becomes even more ridiculous when you examine what the article actually says.

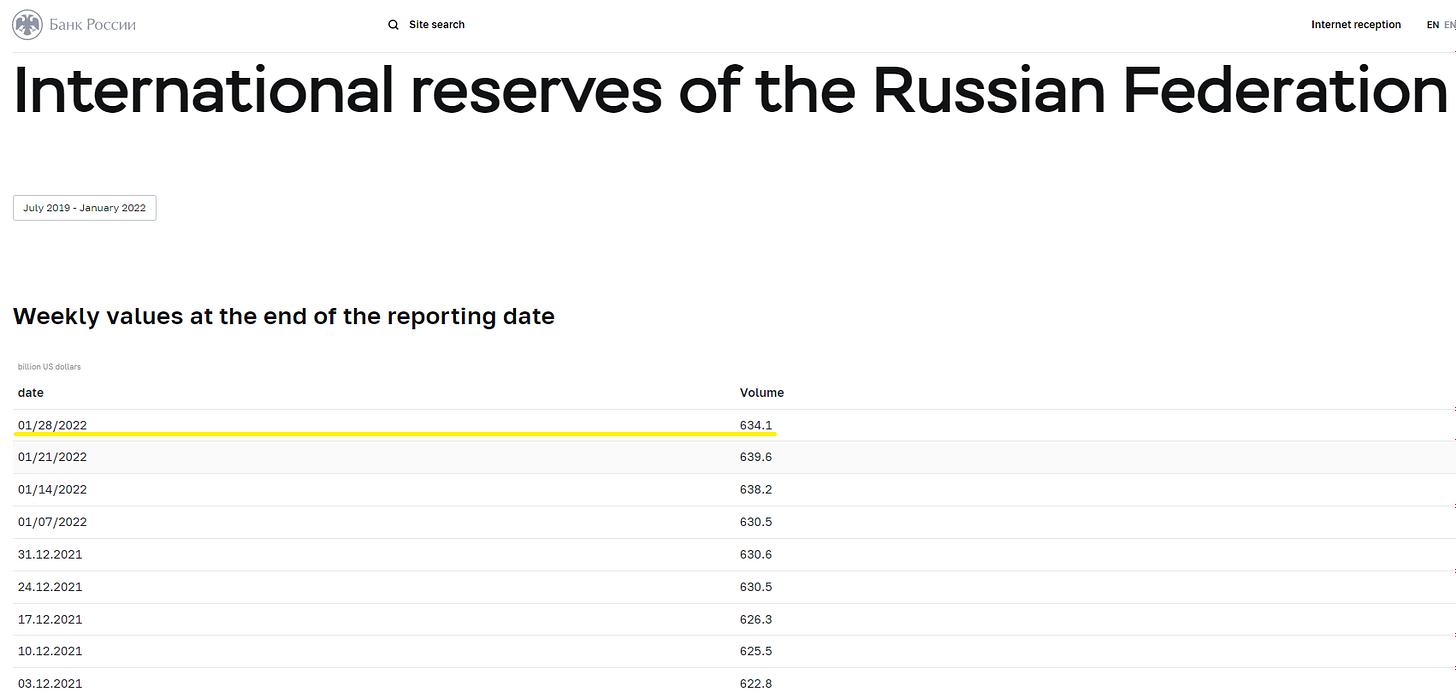

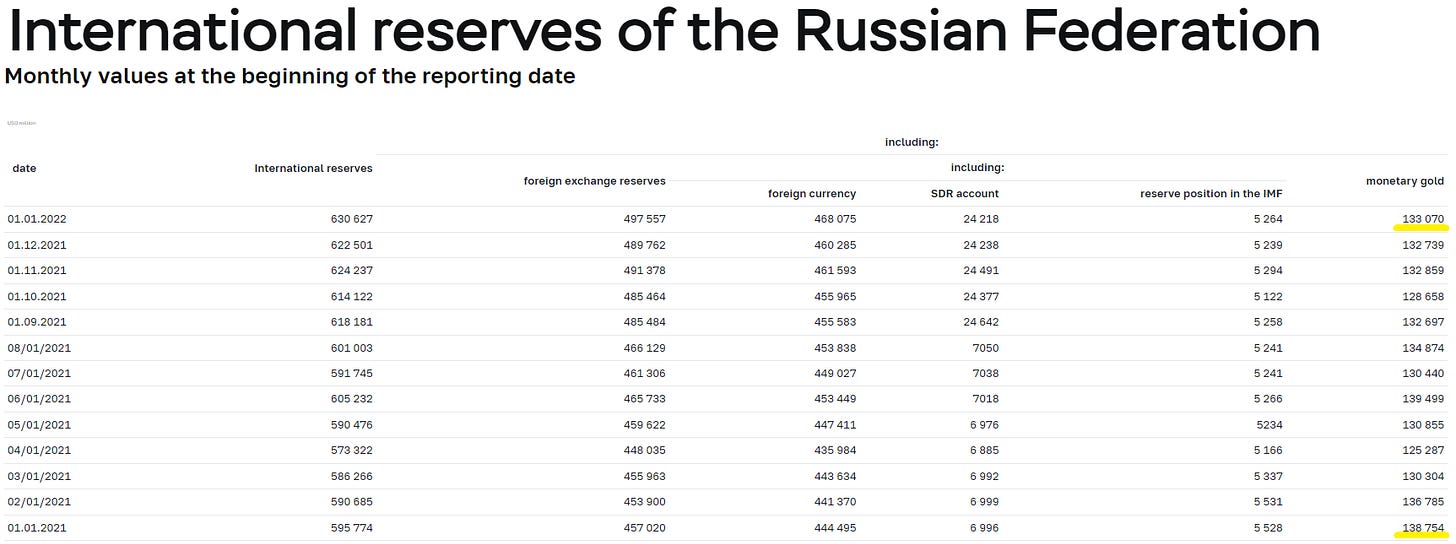

There’s not a single word about Russia’s “record high” mountain of gold. RT’s article is a very greasy repackaging of a press release announcing that the value (in US dollars) of the central bank’s total international reserves (gold + everything else) hit an all-time high of $639.6 billion on January 21. This makes sense because in late January, the price of gold briefly shot up.

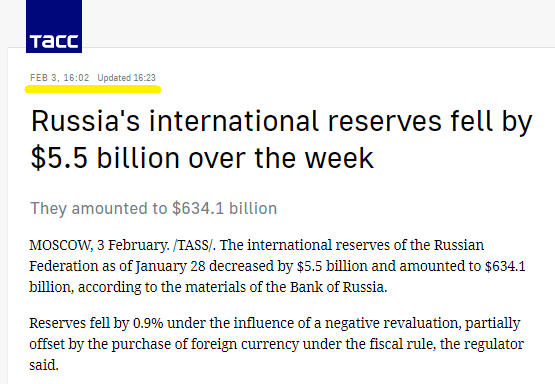

Here’s why this “record value” is deeply misleading: it doesn’t necessarily mean Russia has radically increased its physical gold holdings; in this case, the change appears to be primarily fueled by price fluctuations (in US dollars). For example: in the final days of January, the price of gold tanked. Shortly after RT published its article, the Bank of Russia reported the value of its total international reserves had fallen to $634.1 billion—no longer a “record”!

If the central bank made a gold purchase that hasn’t been reported yet, it clearly wasn’t large enough to offset the price plunge at the end of January. As TASS reported on February 3, Russia’s international reserves fell by $5.5 billion over a seven-day period:

RT pulled a similar clickbait gimmick back in October when it announced “Russia's gold & currency reserves hit record highs.” The first sentence of the article declares: “Russia's international reserves have reached historic levels, with the country investing in assets like gold and foreign currency amid growing economic uncertainty.” Yeah, no. Sorry.

On October 1, the central bank’s gold reserves totaled 73.9 million ounces… the same amount of gold that the Bank of Russia had on January 1 of that year. That’s an interesting investment strategy.

Just to emphasize how misleading RT’s report is: the current listed value (in US dollars) of the Bank of Russia’s monetary gold is less than it was on January 1, 2021:

Again, the problem here is that RT is reporting US dollar value of total international reserves, and then uses extremely misleading language (one might say “lies”) to make it sound like Russia is gobbling up all the gold it can get its hands on. This is very unfortunate because it has caused a great deal of confusion.

Confession: we also got this story (slightly) wrong

Your humble Moscow correspondent is also guilty of misreporting this story. When we wrote about the State Duma freaking out in December about the Bank of Russia halting gold purchases, we incorrectly assumed there was still a total cessation of all purchases.

Actually, the Bank of Russia began buying small amounts of gold in July in order to keep reserves in the range of 73.8-74.0 million ounces. These purchases were made after selling gold, which is why reserves have remained virtually unchanged since April 2020.

Finmarket.ru has a short, no-nonsense article about the “symbolic” growth of the Bank of Russia’s gold reserves over the past year: “In the spring of 2020, the central bank announced that it was suspending the purchase of the precious metal—and indeed, since then, the dynamics of the volume of gold in reserves has been insignificant.”

Reasons for concern

On June 30, Putin commented on Russia’s gold reserves during his annual “direct line” with Russian citizens.

“The main gold reserve of Russia is people. I say this not just as a pretty turn of phrase, not to please anyone, but because I am sincerely convinced that this is true,” the Russian president said.

Just a few days earlier, Putin signed a law canceling the requirements for the repatriation of foreign exchange earnings from “non-resource non-energy exports.” Gold falls under this category.

Not only is Russia shipping almost all of the gold it mines to foreign markets, but now the proceeds of these private sales can be stashed in a Swiss bank account (for example). There’s a word for this: capital flight.

Russians are not happy about this. The conservatives are unhappy. The military nerds are unhappy. The Communists are unhappy.

It’s sort of strange that basically nobody on the English Language Internet is talking about this. Where’s Zerohedge? Aren’t there like 10,000 blogs that regularly yap about Russia and gold and stuff? Yes.

Maybe good news ahead?

It’s possible Russia might do a U-turn soon. Maybe it already has. With oil and gas revenues rebounding, the Ministry of Finance has allocated 585.9 billion rubles for the purchase of foreign currency and gold.

There’s a chance that in the coming days—maybe even today!—the Bank of Russia could announce a large gold haul. That would be cool. Additional measures would need to be taken to stop gold being sucked out of Russia, but baby steps, right?

For now, there’s no official confirmation of any large gold purchases. So reporting on Russia’s “record high stockpiles of gold” seems a bit premature to us.

Another excellent investigative analysis - my network just picked up on this story about a week ago, so it is just getting into circulation in the West. This is a highly significant development and warrants considerably more investigation.

Thank for the heads up on the small recent purchase, but never worry about correcting errors. Transparency is the key.

Excellent work.

Russian central bank must ctl + p rubles out of thin air and buy more gold...which will drive price up (not really since the LBMA and ETFs will hypothecate harder)......but the WEF handlers do not want such optics just yet -- the timing of the great reset must coincide with crashing global markets and it's just too early to drive gold prices up, which you won't own but will be happy knowing your global state holds (not on your behalf) as RT does another propaganda piece on how the One World Gov't holds all the gold in the world so rest assured slave you are golden sans any gold of your own.