Yes, Russia is part of the "sustainable development" revolution

Despite recent geopolitical turmoil, Russia's National ESG Alliance remains committed to "environmental, climate and social initiatives"

The St. Petersburg International Economic Forum is underway and judging from photographs posted on Telegram, dozens of rich people are already networking with alcohol on rooftop terraces. (Hopefully they are all Virus-negative and have no signs of mild illness, otherwise they might have to spend the rest of the conference handcuffed to a hospital bed.)

But the real fun begins next week, with the “business program.”

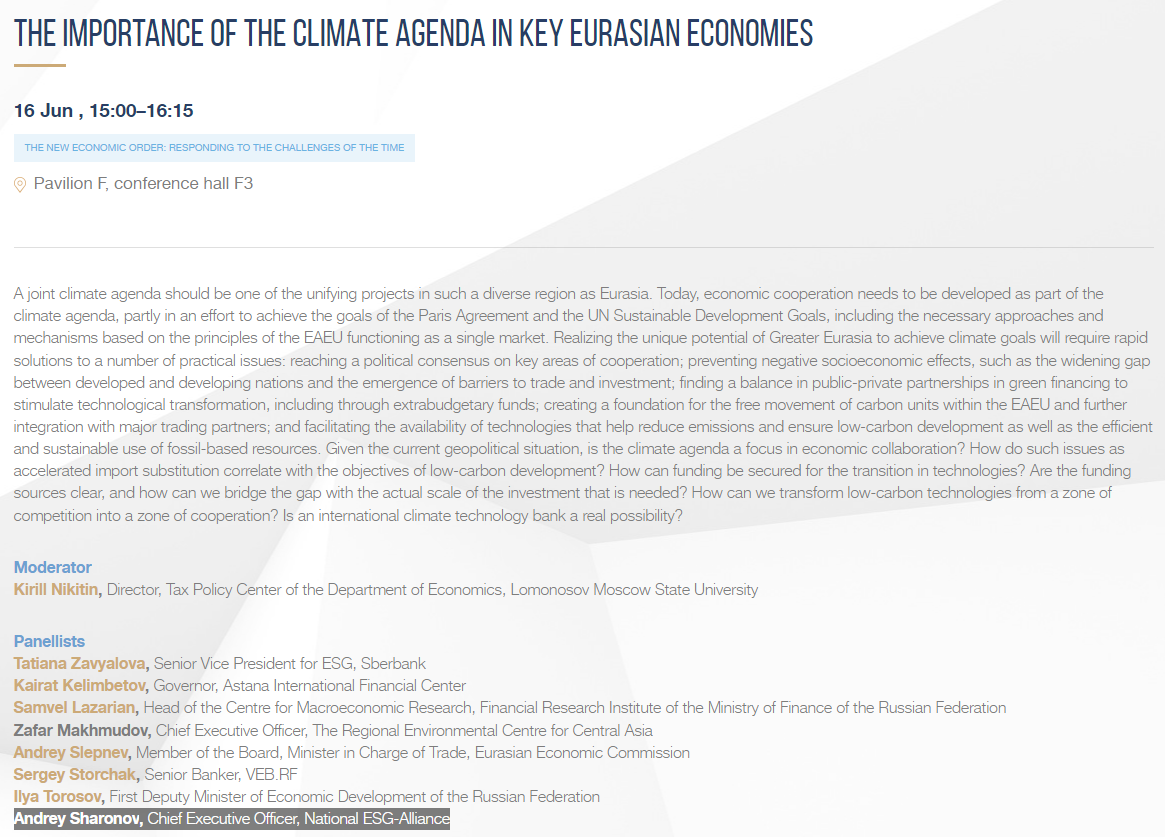

For example, on June 16 SPIEF will discuss “The Importance of the Climate Agenda in Key Eurasian Economies.”

We mentioned this exciting roundtable talk in a previous blog post about this year’s agenda at Russian Davos; however, SPIEF recently updated its website to include the names of moderators and panelists for the 2022 program. So we decided to have a look.

First on the list of panelists for the SPIEF Climate Change Powwow is Sberbank’s senior vice president for ESG, Tatiana Zavyalova.

(For the uninitiated, ESG stands for “Environmental, Social, and Governance.” The obnoxious acronym is almost interchangeable with Schwab’s “stakeholder capitalism” and is used by corporations to rope in “socially conscious investors” and signal their loyalty to the Sustainable Development Revolution.)

We weren’t surprised to see a Sber-lady on this creepy climate panel. After all, Russia’s largest bank isn’t only interested in developing and distributing clot-shots: in 2020, Sber became the World Economic Forum’s climate change missionary for Russia. (Sber CEO Herman Gref is/was a member of the WEF’s Board of Trustees. You can read about some of his Schwabian adventures here.)

“Environment and sustainable development issues — ESG (environmental, social, governance) — rank high on the list of Sberbank’s strategy and corporate culture priorities,” the company said in a September 4, 2020 press release. By joining the WEF’s Climate Governance Initiative (CGI) initiative, Sber would help support “growing awareness and development of competences across boards of directors for the purposes of efficient climate change management.”

Don’t worry, Ukraine-triggered sanctions forced Klaus to cut all ties with his Russian proteges, and now Russia is safe from his slimy climate tricks forever. The SPIEF climate panel is an elaborate 5D shadow-play.

But for the sake of thoroughness, let’s skim the list of experts who are scheduled to participate in this sneaky fake event. At the bottom of the roster is a gentleman named Andrey Sharonov. His profession? CEO of the “National ESG Alliance.”

Try to guess what the National ESG Alliance is. And try to guess who created it. Just make a guess. For fun. Okay, are you ready?

….

….

….

….

In December 2021, Gref did a very bad thing. He assembled his crew of oligarch friends and created an ESG Fan Club.

Founding members of the National ESG Alliance include oil giant Gazprom Neft and Russia’s leading clot-shot dealers/COVID scammers (R-Pharm, AFK Sistema and Pharmstandard).

“The Alliance will aim to facilitate the transition to sustainable economic development by strengthening environmental protection, supporting social development, and enabling business growth while reducing the consumption of natural resources. This will be achieved through commitment, collaboration, and partnership of all the parties involved,” Sber announced on December 1, 2021.

According to the bank’s triumphant press release, the 28 companies who signed up for the “alliance” are responsible for 10% of Russia’s GDP.

Gref issued his own statement to mark this momentous occasion:

As we discussed the issues of corporate social responsibility, transparent and impactful corporate governance and environmental protection, we came to understanding that leading companies needed to combine their efforts to drive this agenda in the country.

We realized that we had to work on shaping regulatory frameworks, standards, and implementation control procedures, forming a new legislation that will stimulate all market participants to comply with ESG standards, and promoting the interests of Russia and Russian companies internationally.

New legislation? ESG standards? Driving the ESG agenda? What does this all mean, in practical terms?

At the end of January, Vedomosti (Russia’s Wall Street Journal) published an in-depth analysis about Gref’s ESG Alliance and how it could possibly accelerate Russia’s adoption of carbon credits:

In July 2021, Russia adopted the main law on limiting greenhouse gas emissions. An infrastructure for the circulation of carbon credits is currently being developed to meet the demand primarily from large emitters of greenhouse gases that are subject to cross-border regulation by CBAM [the EU’s Carbon Border Adjustment Mechanism]. These are producers of steel and iron, aluminum, fertilizers and cement, power industry enterprises. They are interested in a system that would allow them to pay for greenhouse gas emissions in Russia (for example, by buying carbon credits at auction) and at the same time sell products to Europe without paying CBAM, says Maria Spiridonova, senior manager of Deloitte’s sustainability services group in the CIS .

The potential market for trading carbon credits is large. Absorption of greenhouse gases by Russian forests (after amendments to methods for calculating absorption capacity) can reach 1 billion tons of CO2 equivalent, excluding fires, Spiridonova says. If all carbon absorption by Russian forests is taken into account in the form of carbon units, and each unit will be sold at a price of 700 rubles per 1 ton (such an indicator, according to Spiridonova, appeared in the scenarios of the Ministry of Economic Development), the market for carbon units in Russia could reach 700 billion rubles (about $10 billion).

The carbon trading system being created in Russia will at the first stage be voluntary, in contrast to mandatory greenhouse gas emissions trading systems (ETS).

But surely “carbon trading” and other ESG-approved voodoo is no longer a priority, given the highly precarious economic and political situation right now?

On April 21, nearly two months after the start of Russia’s special operation in Ukraine, the Alliance convened a meeting in order to “update” its work plan for the year, “taking into account the specifics of the current political and economic situation.”

The group of socially conscious Russian corporations agreed on an ambitious agenda:

Replenishment and strengthening of the national ESG infrastructure related to reporting, standards, ratings, certification;

Research activities in the national circuit and on the so-called “new” foreign markets;

Contribute to the improvement of national ESG regulation, including the climate and carbon agenda;

Establishing a systematic dialogue with cross-country associations in “new” markets, including the BRICS countries, the EAEU and part of the Asia-Pacific region, as well as establishing interaction with the expert ESG community of these regions;

Educational activities [in Russia] on the subject of sustainable development, directed at a wide target audience.

Yikes.

“We see that, despite the difficulties, companies remain committed to the ESG ideology and do not abandon their earlier commitments to environmental, climate and social initiatives,” Alliance CEO Andrey Sharonov said in response to the outcome of the meeting.

Which brings us to the present day. June 12, 2022. Lord have Mercy.

Here’s what the ESG Alliance and its friends are going to talk about next week in St. Petersburg:

A joint climate agenda should be one of the unifying projects in such a diverse region as Eurasia. Today, economic cooperation needs to be developed as part of the climate agenda, partly in an effort to achieve the goals of the Paris Agreement and the UN Sustainable Development Goals, including the necessary approaches and mechanisms based on the principles of the EAEU functioning as a single market.

Realizing the unique potential of Greater Eurasia to achieve climate goals will require rapid solutions to a number of practical issues: reaching a political consensus on key areas of cooperation; preventing negative socioeconomic effects, such as the widening gap between developed and developing nations and the emergence of barriers to trade and investment; finding a balance in public-private partnerships in green financing to stimulate technological transformation, including through extrabudgetary funds; creating a foundation for the free movement of carbon units within the EAEU and further integration with major trading partners; and facilitating the availability of technologies that help reduce emissions and ensure low-carbon development as well as the efficient and sustainable use of fossil-based resources.

Given the current geopolitical situation, is the climate agenda a focus in economic collaboration? How do such issues as accelerated import substitution correlate with the objectives of low-carbon development? How can funding be secured for the transition in technologies? Are the funding sources clear, and how can we bridge the gap with the actual scale of the investment that is needed? How can we transform low-carbon technologies from a zone of competition into a zone of cooperation? Is an international climate technology bank a real possibility?

And there’s more good news: the “ESG ideology” is spreading across Russia’s business sectors:

ESG is a massive scam and even the normies at the Financial Times are starting to wonder if this goofy extortion racket is on the verge of collapse.

It’s all so ridiculous; it’s hard to think about without exploding.

But we can’t afford to explode because that costs five carbon credits, which we don’t have. Gref has all the carbon credits.

Phew. What a relief.

ah yes a tax. that will appease the weather gods