The Bank of Russia's CBDC: Myth vs Reality

Responses to common misconceptions about the Bank of Russia's digital currency

The Bank of Russia’s digital ruble was officially signed into law on Monday by President Vladimir Putin, after the legislative framework for Russia’s “third form of currency” was ratified by the State Duma earlier this month.

Excluding state and corporate media, the digital ruble has not been particularly well received in Russia—probably because most Russians understand the grave dangers and risks that come with the adoption of a centralized, programmable digital token issued and controlled by an IMF-obedient central bank that operates independently from the Russian state.

However, in Western “alternative media” there still seems to be some confusion about the digital ruble. While Western CBDCs are obviously a tool of total control, Russia’s CBDC is apparently checkmating the globalists—so goes the logic.

I’m sure it’s just a coincidence, but many of the talking points used by digital ruble disciples can be found on a helpful FAQ page on the Bank of Russia’s website.

This article will attempt to clear up some popular misconceptions about this digital nightmare, which is undoubtedly also coming to a country near you.

Myth: The digital ruble is fundamentally different from other CBDCs. There is no potential for abuse

The digital ruble is different from other CBDCs in one respect: the speed at which it is being deployed.

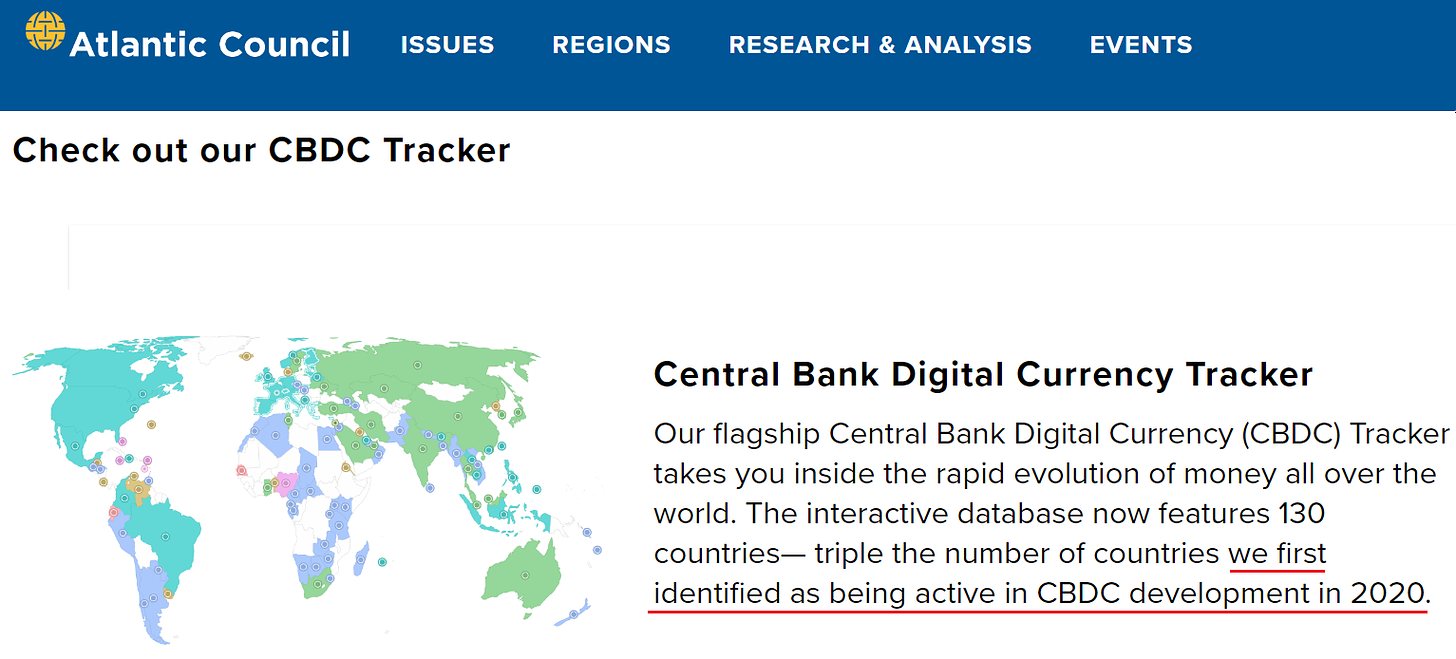

(The Atlantic Council’s CBDC Tracker claims that 130 central banks around the world are in the process of launching their own digital currencies. The Bank of Russia announced its plans to develop the digital ruble in October 2020, and was one of the first central banks to start actively testing its CBDC.)

The digital ruble is virtually identical to other CBDCs. Olga Skorobogatova, First Deputy Chairman of Russia’s Central Bank, said in a recent interview with Forbes that the digital ruble uses the same “architecture” as China’s digital yuan, which is already facing criticism for its dystopian attributes:

Forbes: Was the experience of China used to create the digital ruble?

Skorobogatova: We are very carefully observing and studying the experience of all regulators who are doing similar projects. And the experience of our Chinese colleagues is also extremely indicative for us. […]

Secondly, China used a hybrid architecture—a combination of centralized solutions and blockchain elements. We empirically came to the same conclusion. I must say that at first we created a prototype platform on the blockchain, tested it and quickly realized that the technology was not so mature to fully create industrial solutions on it, especially in terms of payment processing performance. Therefore, in the end, we created a platform on a hybrid architecture: we used a centralized IT solution and a blockchain.

All CBDCs are fundamentally the same, and the global adoption of these centralized digital tokens is being closely coordinated among central banks and other sovereignty-crushing organizations. This is not a secret.

Speaking at Cyber Polygon 2021—which was co-hosted that year by the World Economic Forum and Sberbank—Bank of Russia Deputy Governor Alexey Zabotkin bragged about the digital ruble’s high-tech features and potential uses.

Russia’s CBDC “will permit better traceability of payments and money flow, and also explore the possibility of setting conditions on permitted terms of use of a given unit of currency,” Zabotkin told the WEF-hosted summit.

As for how this new technology could be misused: There are about 1,000 articles from highly reputable, patriotic Russian commentators and media outlets that have nothing but bad things to say about the digital ruble.

For more than a year, this blog has been documenting how Russians inside Russia feel about the Bank of Russia’s CBDC. A few articles that cite views from prominent Russian activists, journalists, economists and lawmakers:

FEB 18, 2022: The digital ruble: Economic sovereignty or enslavement?

JAN 29, 2023: The digital ruble: A friendly CBDC you can trust

MAR 28, 2023: “But the digital ruble is different”

Here’s just a small sampling of recent reactions to the digital ruble’s development and adoption:

Katyusha.org (conservative/patriotic/Orthodox Christian/pro-Putin):

[This week] Putin also signed the law on the digital ruble, sending the Russian Federation down the path beaten by global Satanists from the IMF and the World Bank…

Economist Valentin Katasonov:

I hope that today’s audience doesn’t need to be told that the digital evolution of central banks is a project of creating a digital concentration camp. Well, I'll just briefly note that [CBDCs are] also called “programmable currency”.

Programmable—this means that its parameters are determined taking into account the owner, and the digital currency account or digital wallet. All this is clear from the example of China, where a pilot project for the digital yuan has been underway for two years.

Eduard Kolozhvari, Associate Professor of the Department of Financial Market and Financial Institutions at the Novosibirsk State University of Economics and Management:

[The digital ruble] could be used to limit your shopping, your travel, your freedom. If you are dreaming about a ‘digital concentration camp’ … Such a danger theoretically exists.

Political scientists and financier Igor Nagaev:

With the help of digital money, you can control everything and everyone. This is what any state wants, if only in order to collect as many taxes as possible for the budget.

Duma Deputy Nikolay Arefiev (Communist Party):

Your digital account will be located in the Central Bank, and all information about the movement of your money will merge there. Your resources will be controlled there, and of course, first of all, your money will go to cover debts to the oligarchs, the state, and last but not least, you!

Some of you may not want to have a digital account. But remember how Mir cards were forced on us [We’ll return to this interesting observation shortly — Edward]? It’s just that your pension and salary will be transferred to a digital denomination. Utility payments will be accepted only from a digital account, and if they want, stores will transfer to the digital platform as well.

And you’re not going anywhere! That is why the government is in a hurry with creating digital passports and a digital ruble. If earlier cases were opened only against criminals, now every citizen of Russia will be under surveillance, and by the will or command of one official, you can be left without a salary, a pension.

You get the idea.

Myth: But the digital ruble will help Russia bypass sanctions and protect its sovereignty

Russia already has its own payment system (Mir), which is used to pay state employees and issue social benefits and pensions. (Mir was actually developed by a Belgian firm, and is operated by The National Payment Card System—a subsidiary of the Bank of Russia. Surprise?)

Mir cards are currently accepted in at least nine countries, so why not just expand this network? Why pour time and resources into creating a new system that gives the system operator (the Bank of Russia) near-total control over the entire population? There are obvious answers to this question, but none of them are “to bypass sanctions.”

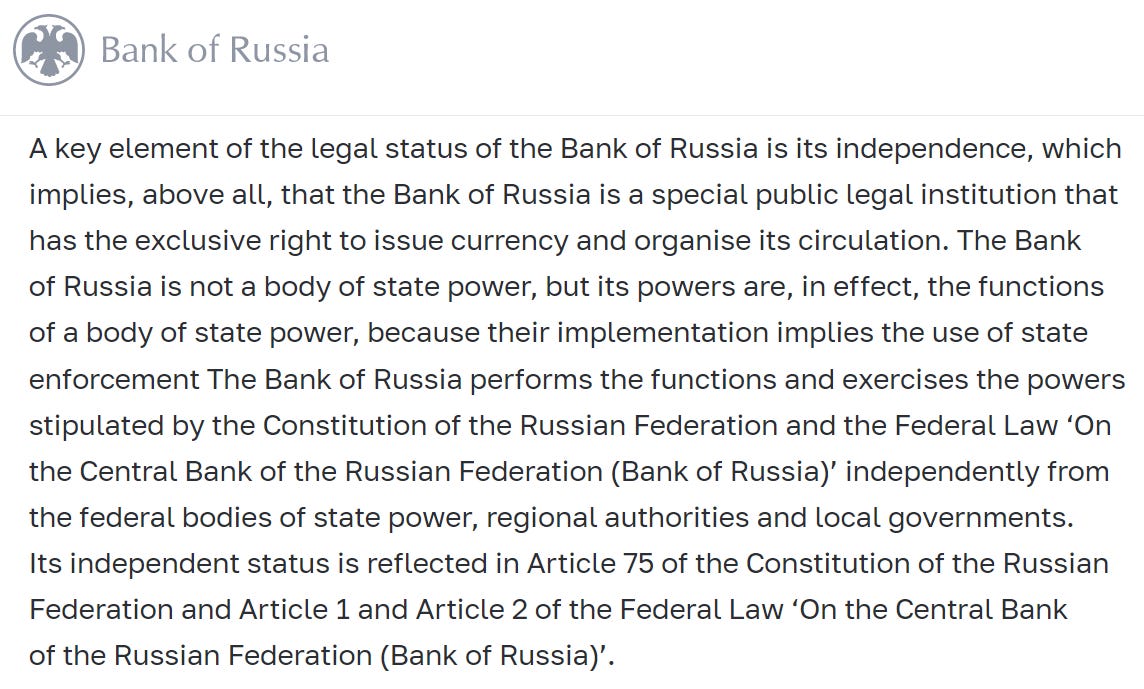

As for the notion that the digital ruble will help strengthen Russia’s sovereignty: How would a CBDC accomplish this, when the digital ruble gives even more power to the Bank of Russia—which is not an entity of the Russian government?

What exactly does the digital ruble have that Mir lacks (minus the total centralization, programmability, and vast potential for limitless abuse)? And how does entrusting this incredibly powerful tool to a non-state entity benefit Russia’s sovereignty?

Myth: There’s nothing to worry about because the digital ruble will be completely voluntary, forever

It will likely take several years for the digital ruble to enter circulation and become a “normal” form of payment, and there is no doubt that cash and non-cash rubles will be used for the foreseeable future.

But the Bank of Russia’s promise that its CBDC will always be optional and voluntary is laughable—especially after “the pandemic”.

Let’s remind ourselves what it means when the Russian government—or any government—promises never to twist your arm….

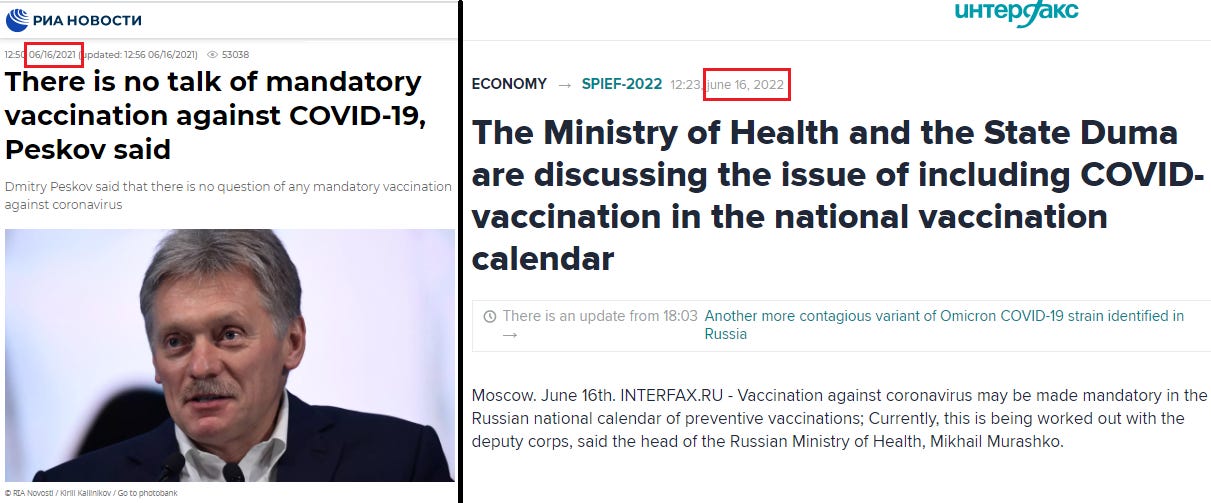

On June 16, 2021, Kremlin spokesman Dmitry Peskov insisted there was “no talk” of making vaccination compulsory at the national level.

Exactly one year later, on June 16, 2022, Russia’s health minister announced he wanted to include COVID shots in the national vaccination calendar. (This hasn’t happened yet, thankfully, but injections were made compulsory at the regional level, and the federal government fully supported this policy.)

In fact, there is already a precedent when it comes to cash bans in Russia, which you can read about here. One glaring example is the decision by Moscow Region authorities to prohibit cash payments for bus tickets.

In March 2020, Moscow Region commuters were temporarily prevented from using cash to pay for bus tickets (because “coronavirus”). The ban was lifted four months later—but now it’s back, and it’s here to stay. And starting on September 1, bus drivers face a fine of up to 5,000 rubles if they dare to accept cash:

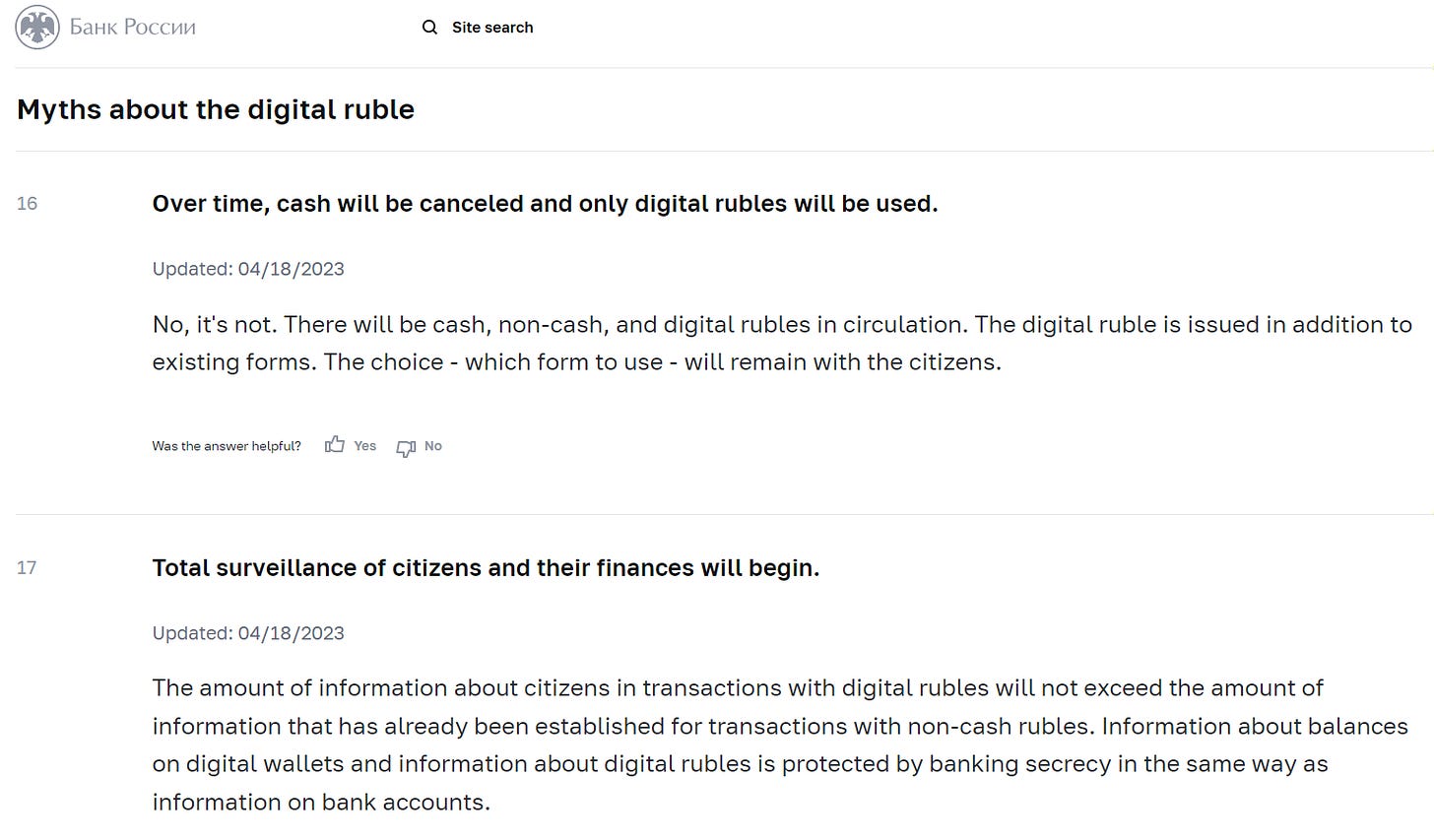

Incredibly, the Bank of Russia’s own FAQ skews (I’m being charitable here) observable reality in 2023, in an attempt to promise that it won’t backstab Russians in the future.

Many Russians are worried that they will be forced to adopt the digital ruble if their government decides to use this “third form” of currency for paying salaries and pensions. Here’s the incredible retort from the Bank of Russia:

There are no such plans. And today a person has a choice how to receive a pension or salary—in cash at the cash desk, at the post office or non-cash on the Mir card.

Although the above sentence is technically correct, it’s missing some important context: The Bank of Russia has done everything in its power to force Russians to switch to the Mir system (which, again, it owns). Furthermore, forcing a state employee to choose between using a Mir card, or no card at all, is by definition a form of coercion.

Thanks to a valiant lobbying effort by the Bank of Russia, legislation was adopted in 2018 requiring state employees to have a Mir card if they want their salaries to be transferred to a bank account (if you want to opt-out, you can get your salary in cash at the “cash desk” of your company, or you can have the money deposited into a bank account that isn’t linked to a card).

In 2021, the Bank of Russia expanded this requirement to maternity payments and other social benefits.

With few exceptions, the only people getting money from the government who aren’t being coerced into using a Mir card are pensioners—but the Bank of Russia previously announced it fully intended to close this loophole.

However, Russia’s kind and caring central bank didn’t want pensioners applying for a Mir card during COVID (because that would mean going outside, and possibly walking to a bank—very dangerous). Instead, they should “self-isolate”, as TASS reported:

At the end of 2020, the Bank of Russia once again postponed the deadline for the mandatory transfer of pensions and other social payments to cards of the Mir national payment system. […]

The Bank of Russia previously explained that the decision to postpone [the requirement for pensioners to switch to Mir] is due to the pandemic and the need for older people to be in self-isolation.

At the same time, the Central Bank noted that more than 96% of pensioners who receive pensions on cards have already been transferred to Mir cards. However, there remains a small proportion of those who have not yet received such a card due to the pandemic, and in the current epidemiological situation, the regulator recommends that banks deliver cards to their homes.

Now that you know all of this, read the Bank of Russia’s “myth-busting” statement one more time:

Impressively slimy. (Make sure to leave the Bank of Russia feedback on its website.)

Please do not shill this gross and disgusting CBDC. It is just like every other CBDC.

Thank you for reading.

Well at least this will put a stop to the massive money laundering done by Russian bus drivers.

"While Western CBDCs are obviously a tool of total control, Russia’s CBDC is apparently checkmating the globalists—so goes the logic."

Jackson Hickle and The Duran would like you to believe that central bank digital currencies issued by Russia or BRICS will be far more liberating, as it will diminish the control of the petro dollar.

Unfortunately, these voices of YouTube global emancipation neglect to mention that regional digital currencies will be interconnected to form an even tighter grip on the world's population as the "global parasites" consolidate power.

As stated in the above article all funds issued by the government will be in the form of a CBDC. So that means pensions, social security, healthcare, etc... will all be tied to this digital currency. Can you see how dangerous this will be if an edict is issued and you don't want to comply. What do you think will happen? I'll answer that--access to your accounts will be denied until you capitulate.🤨

And let's get really creepy, suppose a new "special jab" is mandated, but you don't want to sacrifice your body testing it. Do you think you're going to get your dough if you say no. And didn't we find out during the scamdemic that not every mRNA batch is the same. Some are more deadly, oh I mean more effective than others.

Well how do you know if you're not going to be chosen to take a jab from one of the more "effective" batches? 🤔

If you believe central bank digital currencies will set you free from Global Empire you must also believe the mRNA experimental gene therapy injections are safe and effective.😷